You win gold and you lose silver, isn’t that what they say?

Right now, though, it seems that gold has been cast as the sweet-natured second-choice life partner in a romantic comedy starring AI actress Tilly Norwood.

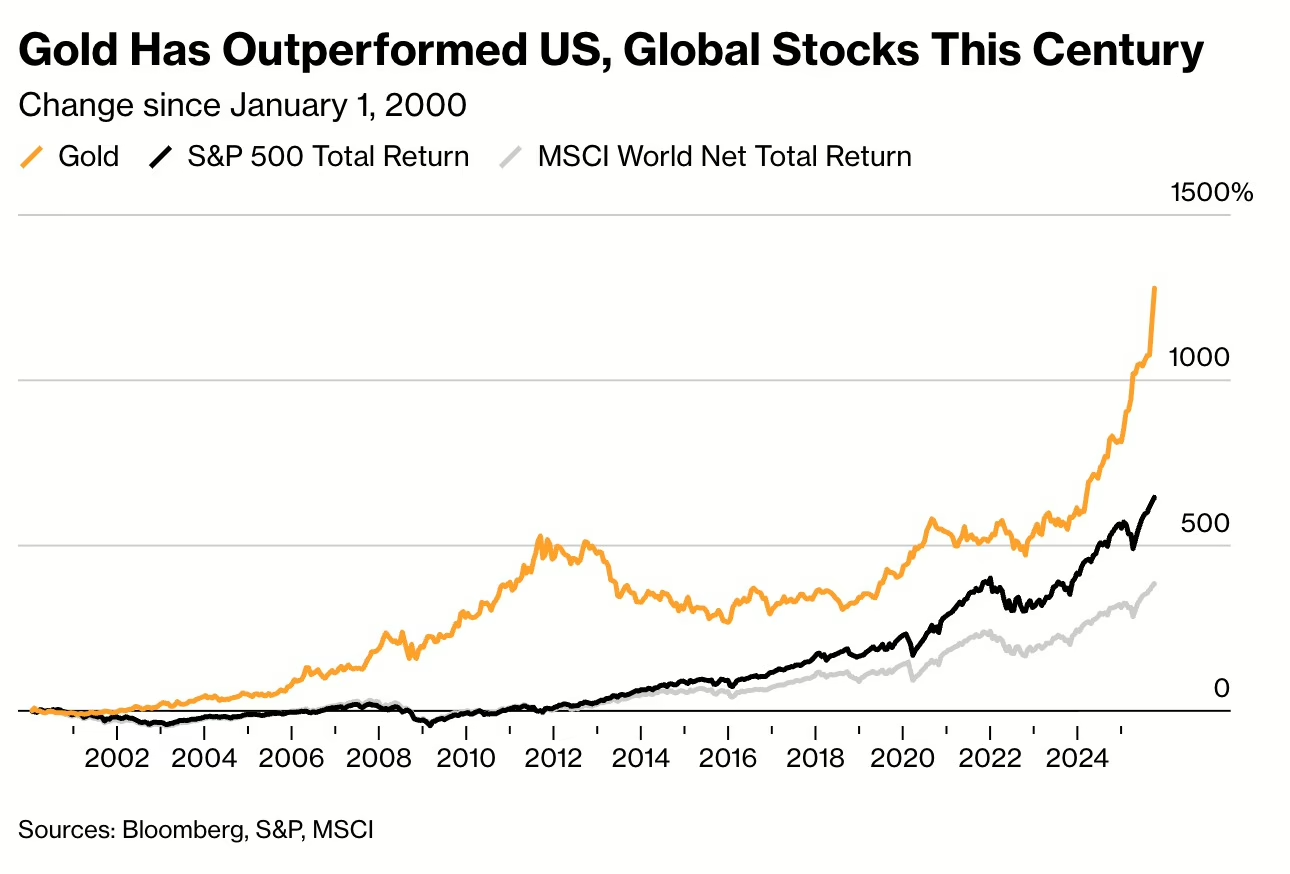

Yes, gold is seeing a huge surge in popularity. Since the turn of the century, gold has vastly outperformed both the US and global stock markets, and this year alone it has been on a regular tear with a nearly 54% price increase so far, a price which this week broke through $4000 per troy ounce.

However, not a single analyst or market observer seems to think it is because of gold being marvelous in itself. It is because other assets are expected to become relatively less appealing.

For example, inflation could have a flare-up, and that might necessitate interest rate hikes to calm the frenzy down. When interest rates go up, asset values come down, et voilà, gold looks comparably better.

Or investors could be concerned about what is in store for their dollar-denominated assets with the US debt growing and the government shutdown and such. When the USD gets weaker, gold gets more affordable, so why not get some of that instead? Buying gold has been the sport of many central banks that have sought to de-dollarize.

But then, you could ask, would that not reverse if the USD strengthens? Yes, it could, but since gold has many shiny sides, its price tends to be downwardly sticky. As its allure might fade for institutional investors and the price starts to go down, retail investors swoop in for a good bargain on family jewelry, and that puts a floor under the whole thing.

And speaking of floors, let us not forget that gold is a physical asset that takes up space and requires at least some security. If you are Scrooge McDuck and like to bathe in your wealth, gold can be more appealing than assets that exist only on paper or in digital wallets. On the other hand, it also carries extra cost in the form of possible transport, storage, and insurance, and in some cases, melting and recasting because of different international contract standards.

Thus, gold might not be the first choice, but if all else looks to fail, it is a decent backup, and it just got a glow-up.

FRG and The Risk Report find gold price movements interesting because we work with risk measurement in commodities, energy, and financial markets.

Regitze Ladekarl, FRM, is FRG’s Director of Company Intelligence. She has 25-plus years of experience where finance meets technology.

This article is part of the FRG Risk Report, published weekly on the FRG blog. To read other entries of the Risk Report, visit frgrisk.com/category/risk-report/.