About a month ago, the Nobel Prize in Economics was awarded to Joel Mokyr, an economic historian, and Philippe Aghion and Peter Howitt, both economists, for their insights on how sustainable growth happens through creative destruction.

Their work is centered on how, since the industrial revolution, continuous technological innovation has allowed for an economic growth pattern that feeds on itself. Growth momentum is sustained by new technology that devalues older technology and pushes innovation.

Seasoned hipsters like me can declare their undying love for vinyls, but record players will probably not become the main auditory channel for music consumption ever again.

So, what does that mean in terms of risk?

The stylized Gartner hype cycle below is one way of illustrating this.

New technology comes along, we think it can fix everything and go on indefinitely, we realize it cannot, the bubble breaks, and only after that is the technology integrated/adopted for sustained growth.

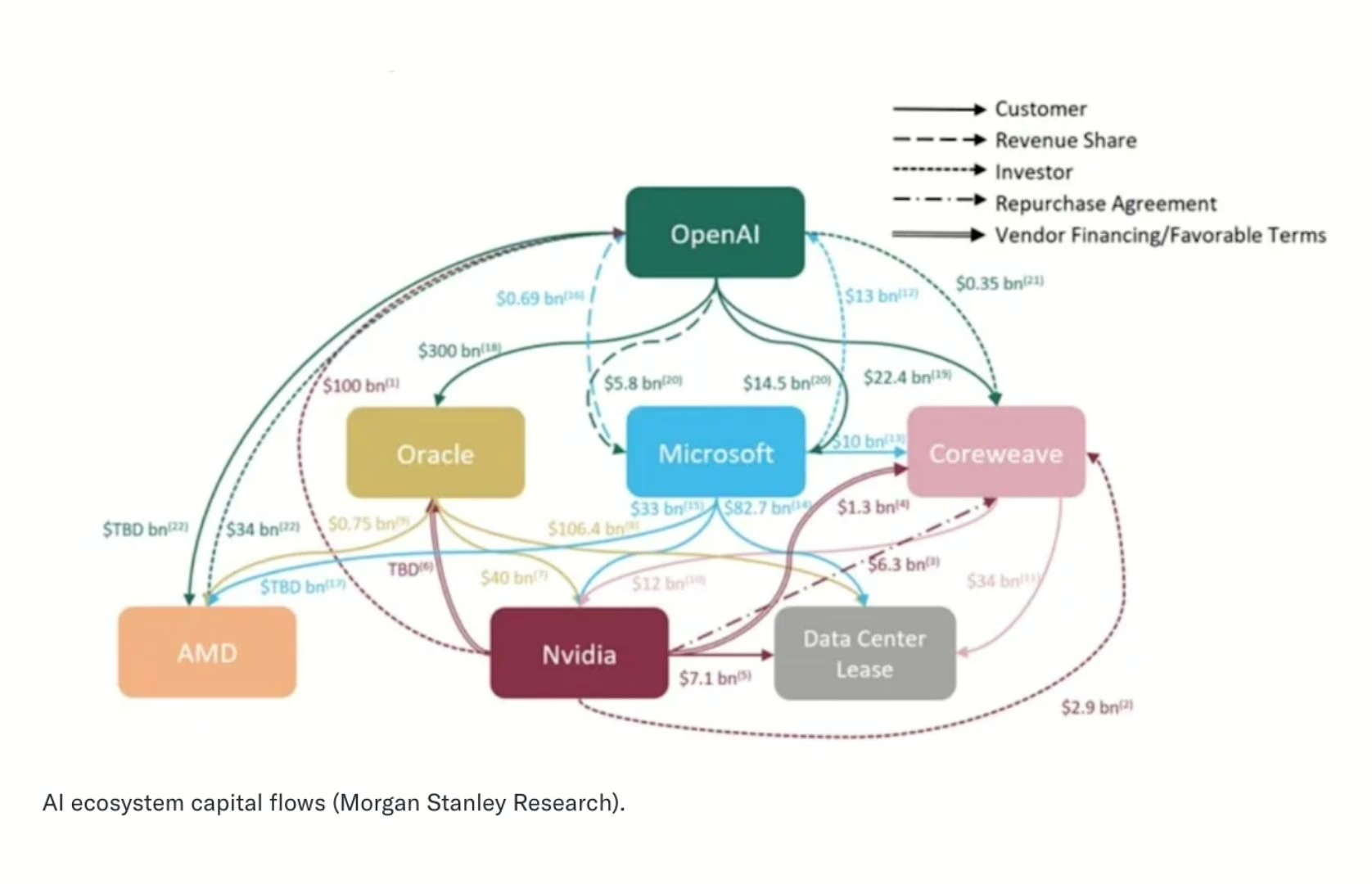

Inflated expectations are, of course, nothing but risk. And in recognition of the risk involved, technological innovation is increasingly financed by private credit, which can be opaque in the way the funding is structured. I am sure that you have seen the “spaghetti” chart of the AI ecosystem of capital flows:

In addition, the devaluing of old technology—this process of creative destruction—also introduces risk, and it is a risk that may not hedge but instead amplify the risk associated with technological innovation.

The risk of new grows, the value of old shrinks, and the gap between them becomes larger. One way to bridge it is with insurance, AKA credit default swaps.

Notably, one of the week’s top stories is how the demand for single name credit default swaps—that is insurance against specific technology firms going bust—has picked up (source: Bloomberg). It remains to be seen if it is a lone bleep on the risk radar or a sign of impending peak.

Even more notably, this week Michael Burry—the man initiating the aforementioned big short—announced he is winding down his hedge fund before the end of the year. As he said in a letter to investors dated October 27th:

My estimation of value in securities is not now, and has not been for some time, in sync with the markets.

FRG and The Risk Report find economic growth and technological innovation interesting because we work with asset valuation and risk measurement in commodities, energy, and financial markets.

Regitze Ladekarl, FRM, is FRG’s Director of Company Intelligence. She has 25-plus years of experience where finance meets technology.

This article is part of the FRG Risk Report, published weekly on the FRG blog. To read other entries of the Risk Report, visit frgrisk.com/category/risk-report/.